The U.S. economy recession looms as a major concern for policymakers and citizens alike, marked by rising uncertainty and faltering consumer confidence. This economic downturn is exacerbated by the ongoing trade war impact, where countries like China and Mexico respond to tariff policies, leading to escalating tensions in global trade. Interest rate cuts are being considered by the Federal Reserve as a potential remedy, but such measures may not be sufficient to offset the negative effects of an economic slowdown. Consumer sentiment, as indicated by the University of Michigan’s index, has plummeted to its lowest point in years, highlighting the growing unease among American households. These factors combine to create a daunting landscape for the future of the U.S. economy as stakeholders brace for possible recessionary conditions.

The current economic climate in the United States is increasingly precarious, as indicators suggest a significant contraction in economic activity may be on the horizon. With the ongoing conflict in trade relations leading to rising tariffs, many citizens are anxious about the implications for job security and overall financial health. While some experts advocate for monetary easing through interest rate reductions, others warn against such hasty measures amidst a backdrop of faltering consumer confidence. The potential for an economic downturn is further complicated by shifting perceptions of risk and instability. As the economic landscape evolves, understanding the distinct challenges that may pave the way for a recession is crucial for citizens and policymakers alike.

Understanding the U.S. Economy Recession Threat

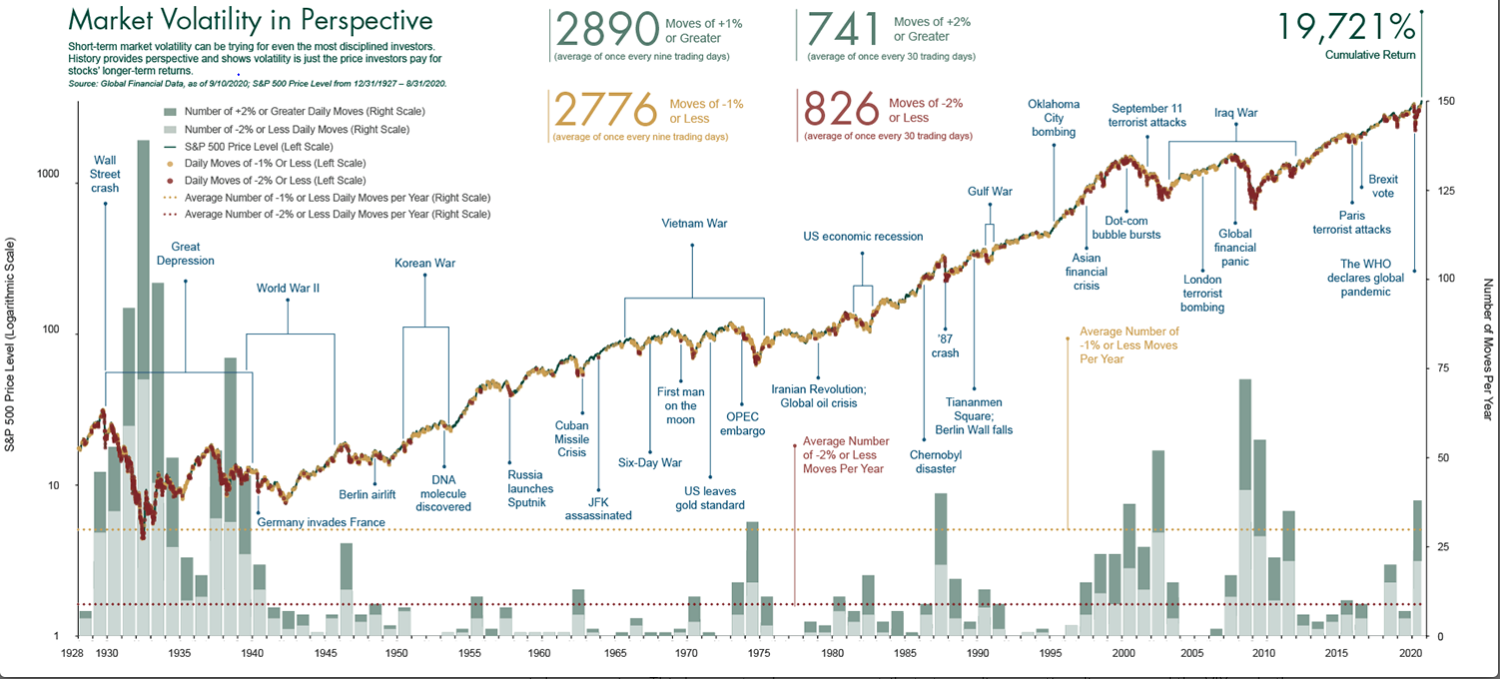

The looming threat of recession for the U.S. economy has become a focal point in recent discussions among economists and policymakers. Detected through declining consumer sentiment and rising uncertainty, many believe that the current geopolitical landscape, particularly the ongoing trade war, is exacerbating these fears. By imposing tariffs, the U.S. government has entered a tug-of-war with other nations, raising concerns that retaliatory actions could deepen the economic fallout. As investors react to these developments, the stock market’s volatility has raised eyebrows and prompted questions about future growth.

Meanwhile, the Federal Reserve is at a crossroads where its decisions on interest rates could significantly impact economic recovery. While rate cuts might provide some short-term relief, they also come with the risk of igniting inflation, especially in the context of increasing tariffs. As indicators of economic strength falter, such as employment rates and spending metrics, the precarious balance between stimulating the economy and curbing inflation has become critical. If inflation continues to rise while consumer confidence remains low, the risk of recession looms larger than before.

Frequently Asked Questions

What are the potential impacts of a U.S. economy recession on consumer sentiment?

A U.S. economy recession typically leads to decreased consumer sentiment, as expressed in the latest University of Michigan consumer sentiment index. When economic conditions worsen, consumers often feel less confident about their financial stability, leading to reduced spending and further aggravating the recession.

How can the trade war impact the likelihood of a U.S. economy recession?

The trade war can significantly heighten the risk of a U.S. economy recession. As tariffs on American goods increase, retaliatory measures from other countries may reduce demand for U.S. exports, resulting in a decline in economic growth and potentially driving the nation closer to recession.

What role do interest rate cuts play in mitigating a U.S. economy recession?

Interest rate cuts are often utilized by the Federal Reserve to stimulate the economy during a recession by making borrowing cheaper. Lower interest rates can encourage consumer spending and business investment, potentially softening the impacts of an economic slowdown.

How does tariff policy affect the risk of a U.S. economy recession?

Tariff policy can exacerbate the risks of a U.S. economy recession by creating uncertainty in the markets and dampening business investment. Increased costs from tariffs can also lead to higher prices for consumers, reducing overall spending and contributing to economic downturn.

Are there indicators that a U.S. economy recession may be happening soon?

Indicators signaling an impending U.S. economy recession include rising trade tensions, declining consumer sentiment, a sluggish stock market, and significant cuts in government spending. Economists are particularly concerned about these factors’ potential to reduce GDP and employment figures.

| Key Points |

|---|

| U.S. economic uncertainty is heightened due to tariffs imposed as retaliation from trade partners like China, Mexico, and Canada. |

| Consumer sentiment has dropped to its lowest since November 2022, indicating reduced economic confidence. |

| Economist Jeffrey Frankel predicts a recession may occur in the next year due to several factors including trade wars and stock market volatility. |

| Federal Reserve faces a dilemma between supporting the economy through interest rate cuts and controlling inflation. |

| Key risks that could lead to a recession include government spending cuts, U.S. fiscal crises, and increased risk perceptions among investors. |

Summary

The U.S. economy recession is a pressing concern, as various factors contribute to a precarious economic outlook. The trade war initiated by tariffs has exacerbated market volatility, leading to decreased consumer confidence and predictions of a looming recession within the year. As the Federal Reserve navigates the conflicting objectives of stimulating growth while controlling inflation, the impacts of uncertainty may linger, potentially disrupting employment and income levels. Without significant policy adjustments, the risk of recession grows more pronounced.